Q: How does the MSBA health plan work? Who’s eligible?

A: The MSBA Association Health Plan (AHP) was developed in collaboration with Mercer, an active partner of the MSBA in offering member benefit solution products, and Medica, a Minnesota-based not-for-profit health plan provider with over 40 years of experience. It offers a portfolio of health benefits options to law firms that have at least one primary owner in good standing with the MSBA and at least one additional individual on staff.

Law firms and their employees will be able to choose from a variety of preferred provider organization (PPO) and health savings account (HSA)-eligible consumer directed health plans (CDHPs). For a law firm to participate, at least 75 percent of its eligible employees must not be enrolled in another health plan, and a minimum of 50 percent (regardless of waivers) must participate in this employer-sponsored plan. The law firm contribution threshold is equal to 50 percent of the lowest-premium employee-only rate.

Q: When can firms start signing up for coverage?

A: MSBA is quoting these plans for eligible member groups beginning with January 1, 2021 plan-effective dates. To request a quote, interested businesses or their brokers may visit Health.MSBAinsure.com or call Mercer customer service at 888-264-9189 for additional details.

Q: I’m a solo practitioner. Why am I left out of the MSBA plan?

A: The federal Department of Labor rules currently in place do not permit association health plans (AHPs) like the one the MSBA has introduced to include sole proprietorships. This may or may not change in the future.

Q: What are the plan’s coverage options?

A: This table offers a breakdown of the plan limit and deductible options.

|

Plan

|

Deductible

|

Out-of-pocket

Maximum

|

Copay

|

Coinsurance

|

|

Preferred Provider Organization (PPO)

|

|

Plan 1

|

$500 / $1,500

|

$3,000 / $6,000

|

$25

|

75%

|

|

Plan 2

|

$1,000 / $3,000

|

$3,500 / $7,000

|

$30

|

80%

|

|

Plan 3

|

$1,500 / $4,500

|

$6,500 / $9,000

|

$30

|

70%

|

|

High Deductible Health Plan (HDHP) with Health Savings Account (HSA)

|

|

Plan 4

|

$2,000 / $4,000

|

$2,000 / $4,000

|

N/A

|

100%

|

|

Plan 5

|

$4,500 / $9,000

|

$6,000 / $13,000

|

N/A

|

80%

|

|

Plan 6

|

$6,650 / $13,300

|

$6,650 / $13,300

|

N/A

|

100%

|

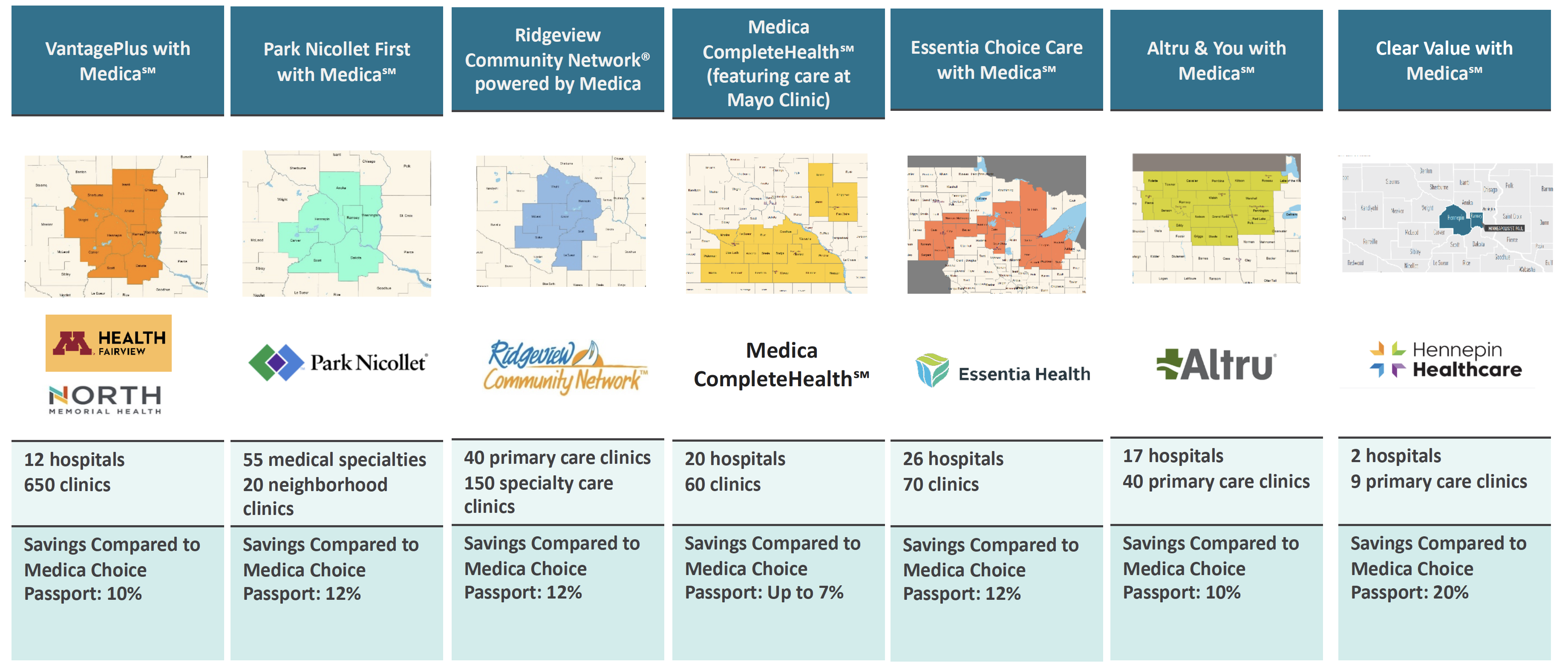

Law firms may also select from Medica’s broad access PPO network, Medica Choice Passport, or from a listing of accountable care organizations (ACOs) available in certain geographic areas throughout the state. An ACO is a network of doctors and hospitals that share the financial and medical responsibility for providing coordinated care to patients; the goal is to limit unnecessary spending, raise the level of care, and lower costs. The ACO plans provide members with a lower price point, which in turn means lower premiums. Medica offers seven ACO networks throughout Minnesota and into western Wisconsin and northeastern North Dakota.

Q: Does the MSBA health plan offer additional benefits?

A: Yes. The AHP provides additional member values-adds that include:

- My Health Rewards: Members 18 and older can earn up to a $160 in gift cards funded by Medica;

- health club reimbursement: $20 credit toward most clubs’ monthly dues;

- Omada for Prevention: online health tools that include a dedicated health coach, lifestyle change recommendations that include healthy eating, activity, sleep, and stress management;

- Ovia Health: parenting support through mobile apps that span the reproductive health and parenting spectrum.

Q: Is support available in implementing and administering the plan?

A: Mercer and Medica will work with any licensed and appointed agent who wants to quote MSBA Association Health Plan to their eligible member clients.

The Mercer Affinity 365+TM platform provides members and their brokers access to obtain medical coverage quotes for employees and their families. The plan also offers an online enrollment and HR administration portal that provides an enrollment and administration experience typically only available to larger employers. Along with this ease of plan administration and enrollment, there is a dedicated customer service team to support you and your employees along the way, ultimately reducing your overall administrative costs associated with providing health insurance.